low risk closed end funds

Using those numbers youre making 4. Register Today To Gain Exclusive Educational Tools Resources Insights From PIMCO.

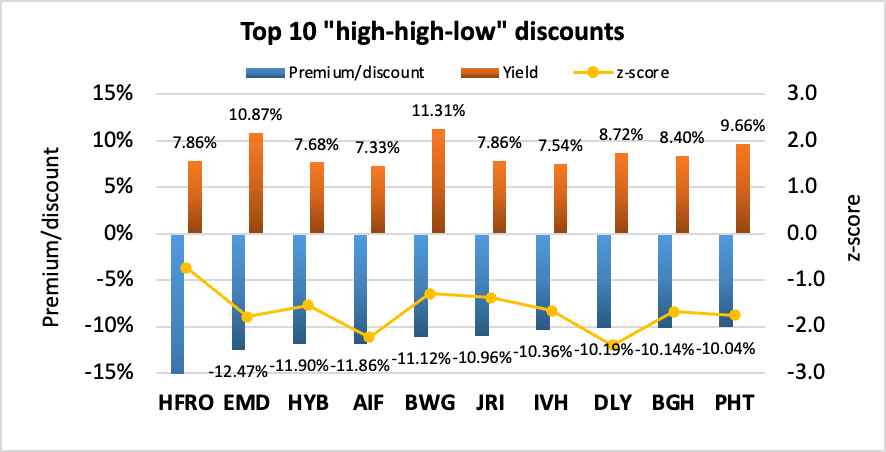

The High High Low Closed End Fund Report April 2022 Seeking Alpha

High Dividend Stock Specialists.

. The math works like this. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. One benefit of this feature is that the investment manager has a relatively stable.

A guide to investing in closed-end funds Press releases Total return CEF Insights Key benefits 01 Stay fully invested Closed structure allows for greater flexibility in the types of investment strategies that can be used and helps portfolio managers stay invested for the longterm. Closed-End Fund Leverage Many closed-end funds employ leverage meaning they borrow funds to increase returns. Those shares are listed on a stock exchange and may be traded at any time during the trading day.

Short-term high-quality bond funds as well as large-cap dividend-focused. However CEF discounts and leverage serve as a double-edged sword that can cut investors particularly deep in bear markets. Past performance and cost efficiency.

But an asset class that has been around since. Ad Learn How Short Duration Solutions Can Help Mitigate Interest Rate Risk Limit Volatility. Learn More About Our Real Estate-Backed Investment Funds With A Current High-Yield Of 90.

Closed-end funds provide investors the ability to buy discounted assets on the cheap and amplify investment income through low-cost leverage. One of their most popular is MANKX which invests in municipal bonds issued by the state of New York. Ad For Income-Seeking Investors the Challenge of Finding Durable Income Is a Major Worry.

Issued in August the three Treasury funds have attracted 164 million in assets with an expense ratio of 015 percent. Without further ado here are 5 closed-end funds that I think are worth buying when they are trading at a bigger-than-normal discount to NAV. George uses the following investment strategies1 Opportunistic Closed-end fund investing.

Choose From Over 50 Funds With 4 5 Star Ratings From Morningstar. Even closed-end funds CEFs which some investors turn to for relative safety versus individual stocks given CEFs diverse portfolios can sport high leverage of between 30 and 60. Finding the Best Closed-End Funds By Geoff Considine July 24 2012 Yield-starved investors have ventured into exotic and often risky assets including hedge funds non-traded REITs and private placements.

If you instead paid a 23 expense ratio youd be left with just 345000 over the same period. Fm plans to issue seven more funds for Treasuries with durations of six months to 30 years. Fms two-year Treasury ETF.

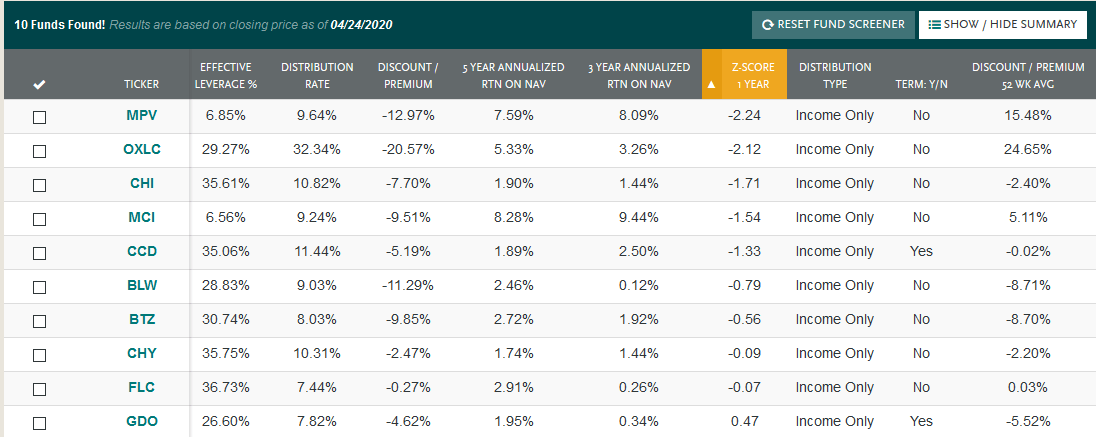

These are the two measures we take of 482 closed-end funds. Buy CEFs at larger than normal discounts to NAV and sell them when the discounts narrow. If you invested five grand a year and got just a 6 annual return youd have over 490000 at the end of 35 years on a fund with a 08 expense ratio.

With all coupon payments reinvested the current 10-year average annual total return of the. High Yield and Low Risk. Explore High-Yield Income Funds To Help Investors Meet Their Unique Goals.

Conversely closed-end funds issue a fixed number of shares usually via an initial public offering IPO. BlackRock Enhanced Capital and Income Fund CII BlackRock has several non-leveraged equity CEFs that sell covered calls over a portion of. Say you can borrow money at a 3 short-term rate and invest it in longer-term assets returning 7.

Closed-end funds raise a certain amount of money through an initial public offering or IPO after which. Register Today To Gain Exclusive Educational Tools Resources Insights From PIMCO. Not surprisingly the funds with the lowest maximum drawdowns tend to cluster in categories we know to be low-risk.

Ad Tailor contract terms to buffer downside risk with FLEX Options. Ad Low Volatility See Our Real Estate Investment Fund Opportunity That Pays Monthly Returns. Closed-end funds have a fixed number of shares outstanding and in that respect are very different.

Ad Learn How Short Duration Solutions Can Help Mitigate Interest Rate Risk Limit Volatility. A closed-end fund or CEF is an investment company that is managed by an investment firm. Closed at 4911 on.

Ad Free List10 Best Closed-End Funds.

Cheap Cefs 7 Closed End Funds With Unusually Low Fees

Switch From This Closed End Fund For Higher Yield And Less Risk Nyse Pai Seeking Alpha

Guide To Closed End Funds Money For The Rest Of Us

5 Best High Yielding Closed End Funds To Buy

5 Best High Yielding Closed End Funds To Buy

Earn Up To 9 With These Closed End Funds Kiplinger

Building An Income Portfolio The Ultimate Guide Here Income

How To Pass The Series 6 Exam Mutual Funds Vs Etf Youtube

Closed End Funds From All Angles

Closed End Fund Cef Investing 14 Criteria For Better Yield

5 Best High Yielding Closed End Funds To Buy

Oil And Gas Closed End Funds Are Getting Crushed The Law Offices Of Patrick R Mahoney P C

Guide To Closed End Funds Money For The Rest Of Us

What Are Closed End Funds Fidelity

:max_bytes(150000):strip_icc()/index-funds-vs-etfs-2466395_V22-d288a73d28154c3c9df884f076f2f6af.png)

Etf Vs Index Fund Which Is Right For You

Closed End Fund Cef Vs Exchange Traded Fund Etf Study Com

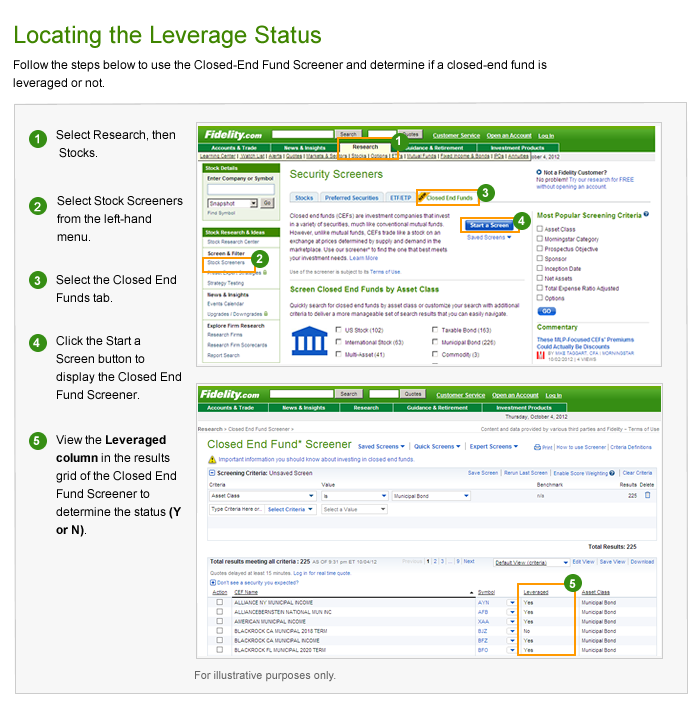

Closed End Fund Leverage Fidelity